Embrace the new financing standards for real assets

Being able to provide reliable data on credit history, financial performances and ESG compliance has become a must to get access to competitive capital.

Altgency enables corporates to map their covenant obligations and structure their key financial & operational data. They can be subsequently processed to support new investment decisions and ease reporting burden.

When data & compliance support new business

A single platform to avoid redundancies and improve knowledge management

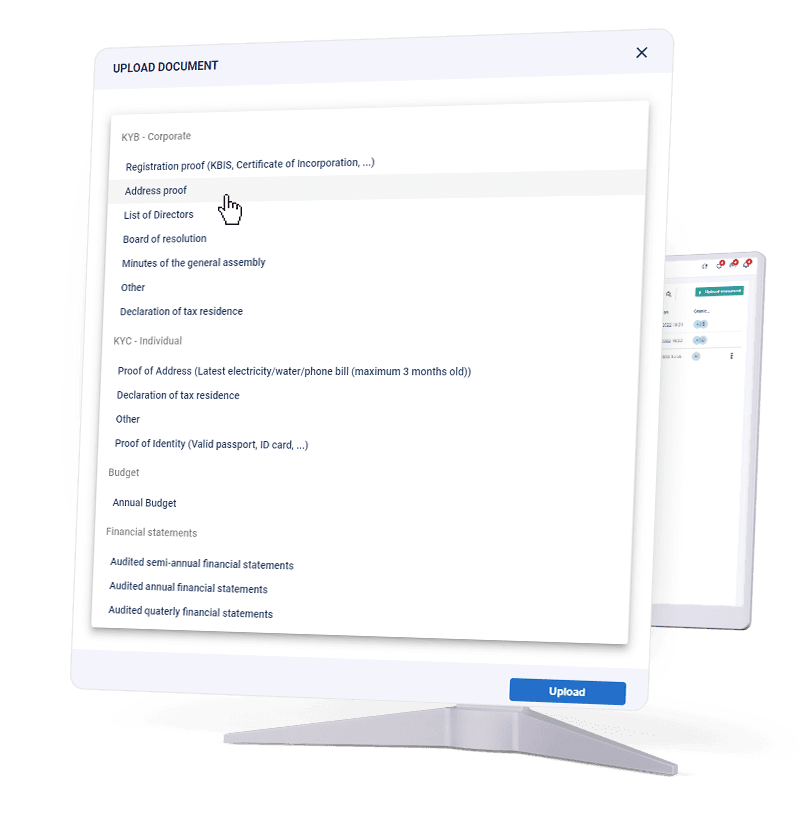

Share KYC documents with bank syndicates and investors

Challenge

Banks & investors generally require the same KYC documents. However and unfortunately, their requests are generally made at different times, leading to repeated and time-consuming phone calls and e-mails for your finance team.

Solution

With Altgency's proprietary dataroom, you can upload all your KYC documents in a single and secured place, accessible at all time by the finance partners of your choice.

Easy to install - Integrates with all your applications

Altgency allows you to connect your loan & equity data with almost every apps. APIs are available on demand.

Request a demo

To set up a custom demo for the specific needs of your business, please fill in the boxes below.